Free tax preparation and tax return filing will be available for students and community members most Saturdays from February 4 to April 8 between 10:00 am - 2 pm in the basement of Rockwell Hall. Taxpayers with an annual income of $60,000 or less and fitting the applicable criteria are eligible for this free service. CSU employees who meet the program criteria are eligible for assistance.

Getting Here

- No appointment necessary, walk-ins welcomed on a first come, first served basis

- The site will be closed March 11 and 18 during CSU’s spring break

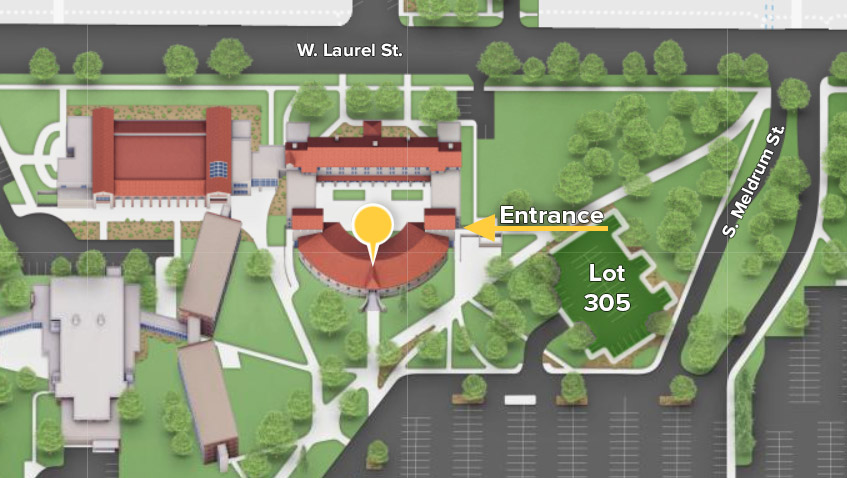

- Free parking is available in Lot 305, directly east of Rockwell Hall

The CSU College of Business is located at 501 W. Laurel Street. Rockwell Hall is the easternmost of the two main College buildings. Follow “VITA Tax Site” signs from the east entrance of Rockwell Hall. The entrance is near the corner of Laurel and Meldrum streets.

Dates

February 4 - Apr 8, 2023

About the Tax Assistance Program

This Volunteer Income Tax Assistance (VITA) service is being provided by Beta Alpha Psi students and community members who are IRS trained and certified volunteers. Volunteers will assist taxpayers complete the IRS Intake/Interview form and check that all documentation is provided before advanced volunteers complete tax returns with the client. Completed returns are checked for completeness, then printed and reviewed with the taxpayer before being electronically filed with the IRS and Colorado Department of Revenue.

What to Bring

- Proof of identification (photo ID)

- Taxpayer's Social Security card for themselves and all dependents claimed on a return

- An Individual Taxpayer Identification Number (ITIN) assignment letter may be substituted for you, your spouse and your dependents if you do not have a Social Security number

- Proof of foreign status, if applying for an ITIN

- Birth dates for you, your spouse and dependents on the tax return

- Wage and earning statements (Form W-2, W-2G, 1099-R,1099-Misc) from all employers

- Interest and dividend statements from banks (Forms 1099)

- Health Insurance Exemption Certificate, if received

- A copy of last year’s federal and state returns, if available

- Proof of bank account routing and account numbers for direct deposit such as a blank check

- To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms

- Total paid for daycare provider and the daycare provider's tax identifying number such as their Social Security number or business Employer Identification Number

- Forms 1095-A, B and C, Health Coverage Statements

- Copies of income transcripts from IRS and state, if applicable

Additional Resources

More information about the VITA program is available at www.irs.gov/individuals/free-tax-return-preparation-for-qualifying-taxpayers

International students and scholars may obtain specialized tax assistance by appointment on Thursdays at the Old Town Library, 201 Peterson Street. Appointments are available at www.makechangenoco.org

This is a community service of Beta Alpha Psi accounting honor society. For more information about BAP or to volunteer e-mail vitatax.csubap@gmail.com